73778 number of user reviews available online which we've scan for Small Business Tax Books. And our experts suggestions available in this article.

Product Recommendation for Best Small Business Tax Books

We have collected information for Best Small Business Tax Books and selected only ten of them based on 73778 reviews. As we believe our shortlist will be helpful whose are also looking for Small Business Tax Books Reviews. However, You can check our scores on Best Small Business Tax Books and read full specifications each of the products. Check our listing for "Small Business Tax Books" -

| No | Product | Score | Action |

|---|---|---|---|

| 1 | 2 Pack Account Tracker Notebook | 9.8 | Buy Now |

| 2 | Adams Bookkeeping Record Book | 9.6 | Buy Now |

| 3 | Think and Grow Rich | 9.6 | Buy Now |

| 4 | Adams Bookkeeping Record Book | 9.4 | Buy Now |

| 5 | Dome 612 Bookkeeping Record | 9.2 | Buy Now |

| 6 | Starting a Business QuickStart Guide: The Simplified Beginner’s Guide to Launching a Successful Small Business | 9.2 | Buy Now |

| 7 | BookFactory Business Expense Journal/Expense Ledger Log Book/LogBook 100 Pages 8.5" x 11" Wire-O (BUS-110-7CW(BusinessExpense)-BX) | 9 | Buy Now |

| 8 | BookFactory Mileage Log Book/Auto Mileage Expense Record Notebook for Taxes - 126 Pages - 5" X 7" Wire-O (LOG-126-57CW-A(Mileage)) | 9 | Buy Now |

| 9 | Small Time Operator: How to Start Your Own Business | 8.8 | Buy Now |

| 10 | Receipt Organizer & Expense Envelopes. Large Envelopes for Organizing & Storing Receipts. Has an Expense Ledger to Record Business Expenses. Matches Receipts to Expenses. Mileage Log on Back. 12/Pack | 8.2 | Buy Now |

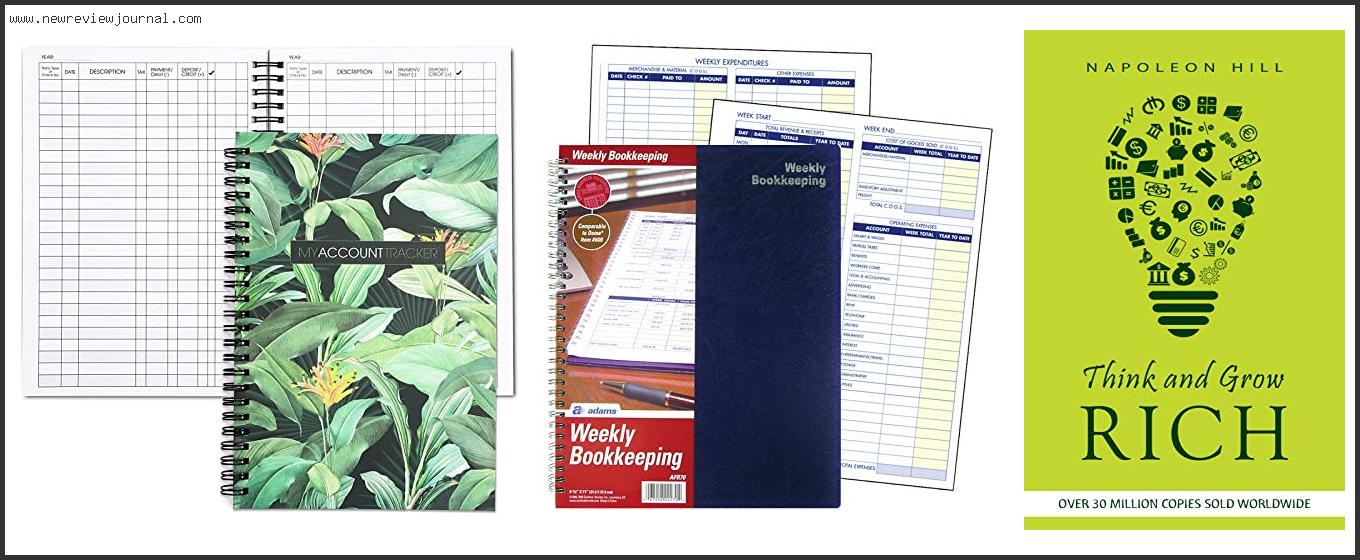

1. 2 Pack Account Tracker Notebook

- Finance Notebook: Manage and organize your personal finances, savings, debts, and bills with this simple money budget tracker.

- Business Expense Tracker: Each sheet in our undated budget tracker notebook has a sizeable amount of space for you to track transaction type, date, description, tax, payment, and deposit.

- Reliable Quality: The small business bookkeeping record book has smooth, double-sided paper that allows you to easily write details from recent transactions.

- Dimensions: Each accounting notebook measures 8.

- What’s Included: This finance tracker notebook set comes in a pack of 2 expense ledger books for your personal or business finances.

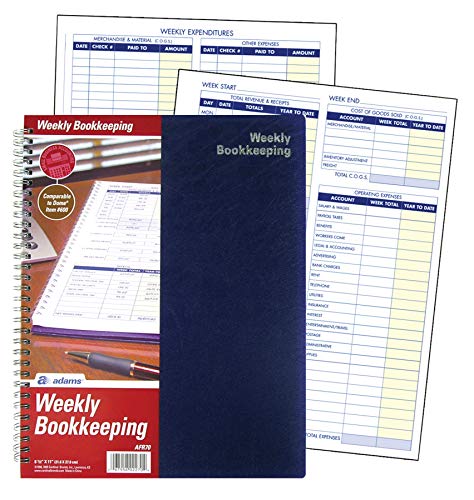

2. Adams Bookkeeping Record Book

- Allows you to track all aspects of your business

- Track expenditures from payroll to revenue and income

- Weekly version

- Non-dated format allows you to start any time of the year

- 8.5 x 11 inches

3. Think and Grow Rich

4. Adams Bookkeeping Record Book

- Allows you to track all aspects of your business

- Track expenditures from payroll to revenue and income

- Monthly version

- Non-dated format allows you to start any time of the year

- 8.5 x 11 inches

5. Dome 612 Bookkeeping Record

- Record Book Offers A Simple Way To Keep Accurate Records Of Cash Received And Paid Out.

- Wirebound Record Book With Lexhide Cover Is Undated And Good For A Full Year.

- Book Contains 128 Pages.

- Country If Origin : United States

- Bookkeeping Records. Record of Cash Received and Paid Out. Includes Net Profit, Net Worth, Payroll.

- Record of Cash Received and Paid Out.

- Includes Net Profit, Net Worth, Payroll.

- Undated – start anytime.

- It has 128 pages, wirebound.

6. Starting a Business QuickStart Guide: The Simplified Beginner’s Guide to Launching a Successful Small Business

7. BookFactory Business Expense Journal/Expense Ledger Log Book/LogBook 100 Pages 8.5″ x 11″ Wire-O (BUS-110-7CW(BusinessExpense)-BX)

- This is a great book for small businesses to use to track expenses by day, week, and month.

- There are spaces to track automobile, meals, travel, and other misc.

- 110 Page Business Expense Journal 8.5″ x 11″

- Printed Full Color Business Expense Cover with Translux for Protection

- Made in USA, Proudly Produced in Ohio. Veteran-Owned.

8. BookFactory Mileage Log Book/Auto Mileage Expense Record Notebook for Taxes – 126 Pages – 5″ X 7″ Wire-O (LOG-126-57CW-A(Mileage))

- This record book has space for 354 car trips

- There are pages to log your annual mileage summary as well as your annual expense summary

- Durable Translucent Cover, Side Bound Wire-O Binding

- Archival safe, acid-free, 60 lb. paper, Page Dimensions: 5″ x 7″

- Made in USA, Proudly Produced in Ohio. Veteran-Owned.

9. Small Time Operator: How to Start Your Own Business

10. Receipt Organizer & Expense Envelopes. Large Envelopes for Organizing & Storing Receipts. Has an Expense Ledger to Record Business Expenses. Matches Receipts to Expenses. Mileage Log on Back. 12/Pack

- An Organizer for Business Expenses that also Files & Stores Your Receipts.

- Match Receipts to Expenses! Record an expense on a line (1-30) on the expense ledger, and then mark the receipt with the same number as the line where you listed the expense.

- Includes an Auto Mileage Log.

- Track Business Expenses & Tax Deductions.

- Organizes Bookkeeping, Accounting and Tax Preparation.

Best Small Business Tax Books Buying Guide

Does the thought of finding a great Best Small Business Tax Books stress you out? Has your mind been juggling between choices when it comes to buying Best Small Business Tax Books in general, specifically regarding which model to choose?

If that’s the case, know that you’re not alone. Many people find it tough to buy the perfect Best Small Business Tax Books for themselves. We understand the stress associated with the buying process!

Since you’re here, you are obviously curious about Best Small Business Tax Books Reviews. You’ve been bombarded with information, so you need to find a reputable source with credible options before you make any decisions on which product would be best for your needs.

There are many sources that’ll provide you with that information- buying guides or ratings websites, word-of-mouth testimonials from friends or family members, online forums where users share their personal experiences, product reviews specifically found all over the internet and YouTube channels. Only thorough research will ensure that you get the right product.

But that’s not always easy, right? That's why we've taken time to compile a list of the Best Small Business Tax Books in today's market, on your behalf, so that there will be no more worries for you.

How did we come up with the list, you ask? How did we create this buying guide?

- First, our algorithms collected as much information available about these products from trusted sources.

- We employed both Artificial Intelligence and large data volume to validate all collected information.

- Then our AI ranked them on their quality-to-price ratio using industry-standard criteria that let us pick the Best Small Business Tax Books currently on the market!

The products aren’t chosen randomly. We consider several criteria before assembling a list. Some of the criteria are discussed below-

- Brand Value: What happens when you go for a not-so-reputable brand just because the price seems cheap? Well, the chance of getting a short-lasting product goes higher. That’s because the renowned brands have a reputation to maintain, others don’t.

Top Best Small Business Tax Books brands try to offer some unique features that make them stand out in the crowd. Thus hopefully, you’ll find one ideal product or another in our list.

- Features: You don’t need heaps of features, but useful ones. We look at the features that matter and choose the top Best Small Business Tax Books based on that.

- Specifications: Numbers always help you measure the quality of a product in a quantitative way. We try to find products of higher specifications, but with the right balance.

- Customer Ratings: The hundreds of customers using the Best Small Business Tax Books before you won’t say wrong, would they? Better ratings mean better service experienced by a good number of people.

- Customer Reviews: Like ratings, customer reviews give you actual and trustworthy information, coming from real-world consumers about the Best Small Business Tax Books they used.

- Seller Rank: Now, this is interesting! You don’t just need a good Best Small Business Tax Books, you need a product that is trendy and growing in sales. It serves two objectives. Firstly, the growing number of users indicates the product is good. Secondly, the manufacturers will hopefully provide better quality and after-sales service because of that growing number.

- Value For The Money: They say you get what you pay for. Cheap isn’t always good. But that doesn’t mean splashing tons of money on a flashy but underserving product is good either. We try to measure how much value for the money you can get from your Best Small Business Tax Books before putting them on the list.

- Durability: Durability and reliability go hand to hand. A robust and durable Best Small Business Tax Books will serve you for months and years to come.

- Availability: Products come and go, new products take the place of the old ones. Probably some new features were added, some necessary modifications were done. What’s the point of using a supposedly good Best Small Business Tax Books if that’s no longer continued by the manufacturer? We try to feature products that are up-to-date and sold by at least one reliable seller, if not several.

- Negative Ratings: Yes, we take that into consideration too! When we pick the top rated Best Small Business Tax Books on the market, the products that got mostly negative ratings get filtered and discarded.

These are the criteria we have chosen our Best Small Business Tax Books on. Does our process stop there? Heck, no! The most important thing that you should know about us is, we're always updating our website to provide timely and relevant information.

Final Words

Since reader satisfaction is our utmost priority, we have a final layer of filtration. And that is you, the reader! If you find any Best Small Business Tax Books featured here Incorrect, irrelevant, not up to the mark, or simply outdated, please let us know. Your feedback is always welcome and we’ll try to promptly correct our list as per your reasonable suggestion.

Some Results From Online About small business tax books

Amazon Best Sellers: Best Small Business Taxes

Discover the best books in Amazon Best Sellers. Find the top 100 most popular Amazon books.

The Top 6 Books on Tax and Bookkeeping for Small Business ...

1. Small Time Operator: How to Start Your Own Business, Keep Your Books, Pay Your Taxes, and Stay Out of Trouble · 2. Taxes: For Small Businesses QuickStart ...

Tax Time: 5 Accounting Books for Small Business Owners | Inc.com

Mar 28, 2019 ... Tax Time: 5 Accounting Books for Small Business Owners · 1. 475 Tax Deductions for Businesses and Self-Employed Individuals: An A-to-Z Guide to ...

J.K. Lasser's Small Business Taxes 2022: Your ... - Amazon.com

This item: J.K. Lasser's Small Business Taxes 2022: Your Complete Guide to a Better Bottom Line. by Barbara Weltman · J.K. Lasser's 1001 Deductions and Tax ...

Small Business Issues, Small Business Ideas; Barbara Weltman

Books · J.K. Lasser's Small Business Taxes 2022 · J.K. Lasser's 1001 Deductions & Tax Breaks 2022 · 500+ Big Ideas for Your Small Business · Home Business ...

33 Best Small Business Taxes Books of All Time - BookAuthority

33 Best Small Business Taxes Books of All Time · Nolo's Guide to Single-Member LLCs · Top Small Business Tax Deductions · The Tax and Legal Playbook · Bookkeeping ...

What kind of records should I keep | Internal Revenue Service

Mar 14, 2022 ... Your books must show your gross income, as well as your deductions and credits. For most small businesses, the business checking account is the ...

Small Business Tax Services: Tax Prep, Bookkeeping, Payroll | H&R ...

Our small business-certified tax pros specialize in taxes. And we guarantee 100% accuracy in our taxes, bookkeeping, and payroll. Explore our SMB services.

4 Best New Small Business Taxes Books To Read In 2022 ...

4 Best New Small Business Taxes Books To Read In 2022 · Small Business Taxes For Dummies ) · J.K. Lasser's Small Business Taxes 2022 · Deduct It! · Tax Savvy for ...

Corporate & Business Taxes, Taxes & Taxation, Books | Barnes ...

Results 1 - 20 of 485 ... The Tax and Legal Playbook:… · Mark Kohler · $21.99 ; 475 Tax Deductions for… · Bernard B. Kamoroff C.P.A. · $19.95 ; Tax-Free Wealth: How to ...